- August 9, 2016

- Posted by: Phillip W. Duff

- Categories: Agencies, Buyers, Compliance, Latest Post, Opinions, Training

Debt collection is a high stakes game centered around high emotions on both sides.

The trouble is, when emotions get out of hand, you lose control of the debt collection process.

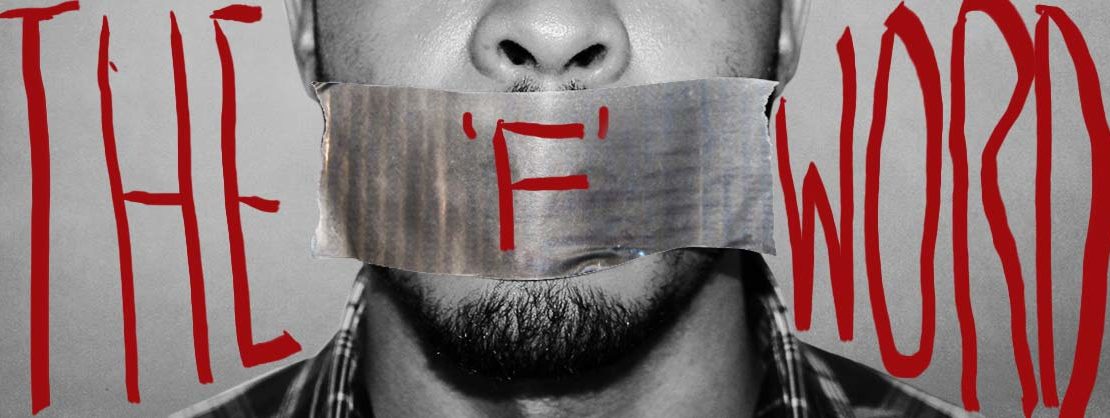

Always remember Failure is not an option. Uttering the “F” word in this industry spells trouble for your business. However, success is dependent on finding creative solutions that address the many industry issues companies face.

When emotions get high self preservation kicks in quickly, creating defensiveness and instincts resembling the fight or flight response to danger. Consumers are keen to preserve income by failing to pay, and debt collectors must extract payments to stay in business. Compromise and cooperation can be hard to come by, with so much at stake.

Collection agencies are in a tough business right now. We face issues created by regulations, which largely favor the consumer. We face issues created by the debtors, who refuse to pay their obligations or follow through with payment agreements. We face issues created internally by staff or infrastructure. To succeed in this environment companies must refuse to accept Failure as not an option and find innovative ways to succeed.

As a consultant in the industry for the last two decades, I have seen a major industry shift in compliance making it more difficult and expensive to operate your business. The result is the cream rising to the top. The very best collection agencies and law firms are spending the time and money to ensure failure does not occur. They are finding success by aligning with vendors specializing in the industry, improving training for staff, hiring industry consultants who understand the challenges you face, and improving their procedures and processes. The cream rising to the top will lead the collection industry for decades to come.

As a consultant in the debt collection industry, I see both sides of the fence. On the one side are aggressive agencies seeking out improvements, training, automation and better processes. On the other side are agencies doing just the minimum to get by, hoping the regulatory environment will change before they have to spend the money on upgrades. It is very obvious to an industry veteran, like myself, which strategies are the most successful.

Most owners and managers are burdened with daily operations tasks to keep the agency or law firm profitable and in compliance. They do not have the time to investigate the necessary improvements required to maximize efficiency and stay on top of new compliance rules. This reactionary response is more expensive in the long run than taking a proactive approach to legislative changes. As CFPB enforcement increases, it makes more sense than ever to hire an outside consultant to provide innovative solutions for your agency or firm. Changes in both compliance and technology are creating both roadblocks and opportunities for those on the leading edge. Identifying which is essential to an agencies success.

Lighthouse Consulting has been a beacon of knowledge in the debt collection industry for almost 20 years. If you are looking for reliable advice and an intimate understanding of your needs, contact Lighthouse Consulting for information on our services.

Leave a Reply

You must be logged in to post a comment.