- December 4, 2017

- Posted by: Phillip W. Duff

- Categories: Compliance, Finance & accounting, Law Firms, Opinions, Regulations, Technology, Training, Uncategorized

Lighthouse Consulting assisted its clients and industry vendors to create multichannel debt collection strategies and technology. Several years ago we saw the opportunity arising for more Technology base Collection strategies. As we work with vendors to create payment websites, email campaigns, texting opportunities and more electronic communication channels we began to find Best practices. As I look out into the industry today it is easy for me to look at a collection agency website and follow it through to the pay here page and quickly evaluate the site based upon the login criteria.

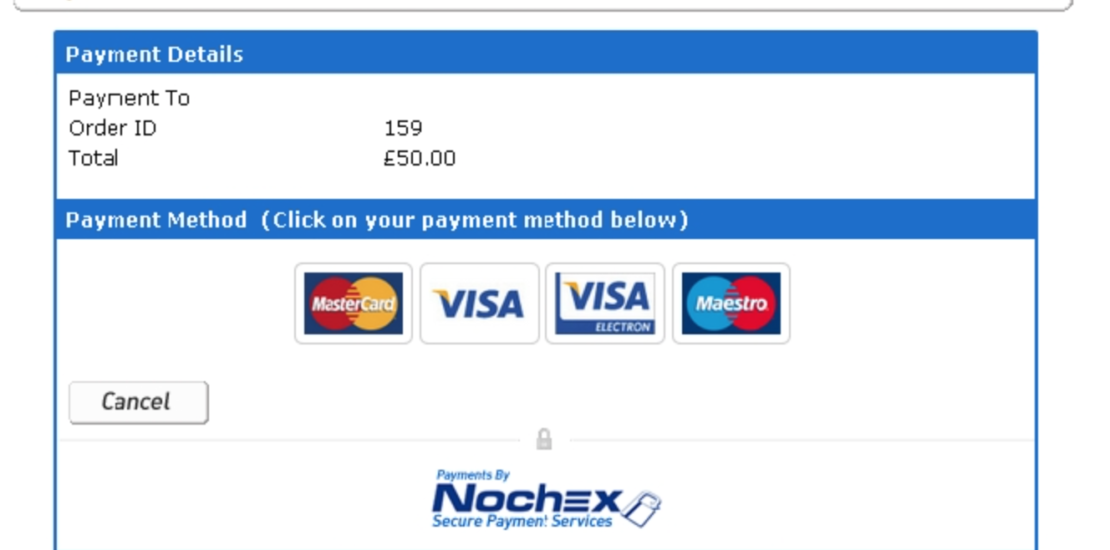

Recently one of my clients asked me to recommend a vendor that would integrate with their software and provide a payment website for their consumers. I ended up not only recommending a vendor but working with the collection agency to make sure set up of the payment site was the most effective strategy. Settlement parameters, payment parameters and navigation of the site all lead to conversions also known as payments. A good payment site also gets an opt in from the consumer for future cell phone calls, emails and text messages.

My clients compliance department and lawyers help to create the compliance statement and the opt in language for the payment site after I had consulted with them on the effectiveness and navigation of the website. I worked with them to test the site and when all was working properly my work was done. The client made the website live and began to take payments and collect data a few days later. Even though my job was completed two weeks later I requested some data from my client from the website. It showed a large abandonment rate at the login page.

I first began looking for the problem within the code of the website page and could find nothing. I looked at the Google analytics for the page to confirm the abandonment rate. I began to evaluate the time of day and day of the week of the abandonments and found no correlation. Then I logged onto the payment site and it was very obvious what the problem was. The data required to log into the website and pay your bill was hindering the consumers ability to log on. The site was asking for the collection agency Account number as one of the data points to log onto the site. This means that the consumer must not only have a letter from the collection agency in front of them but must be able to type in many numbers correctly probably from their cellular device. When the consumer did not either have the account number or did not type it in correctly the first time they abandoned the attempt. This is what was causing the high abandonment rates, once the log in was changed to last name and last 4 of SSN the abandonment rate no longer was a problem.

I have learned that if you are making it difficult for the consumer to log on to or to navigate through your payment website you are leaving money on the table. If you are looking for advice on how to set up any part of your multichannel Collection strategy contact Lighthouse Consulting.

Leave a Reply

You must be logged in to post a comment.